Angela Wilhelm is the CEO and president of Oregon Business & Industries. She heads the No on Measure 118 campaign. The Oregon Eagle asked her a series of questions about Measure 118 and how it would impact families and businesses in Oregon.

How would you summarize Measure 118 for Oregon voters?

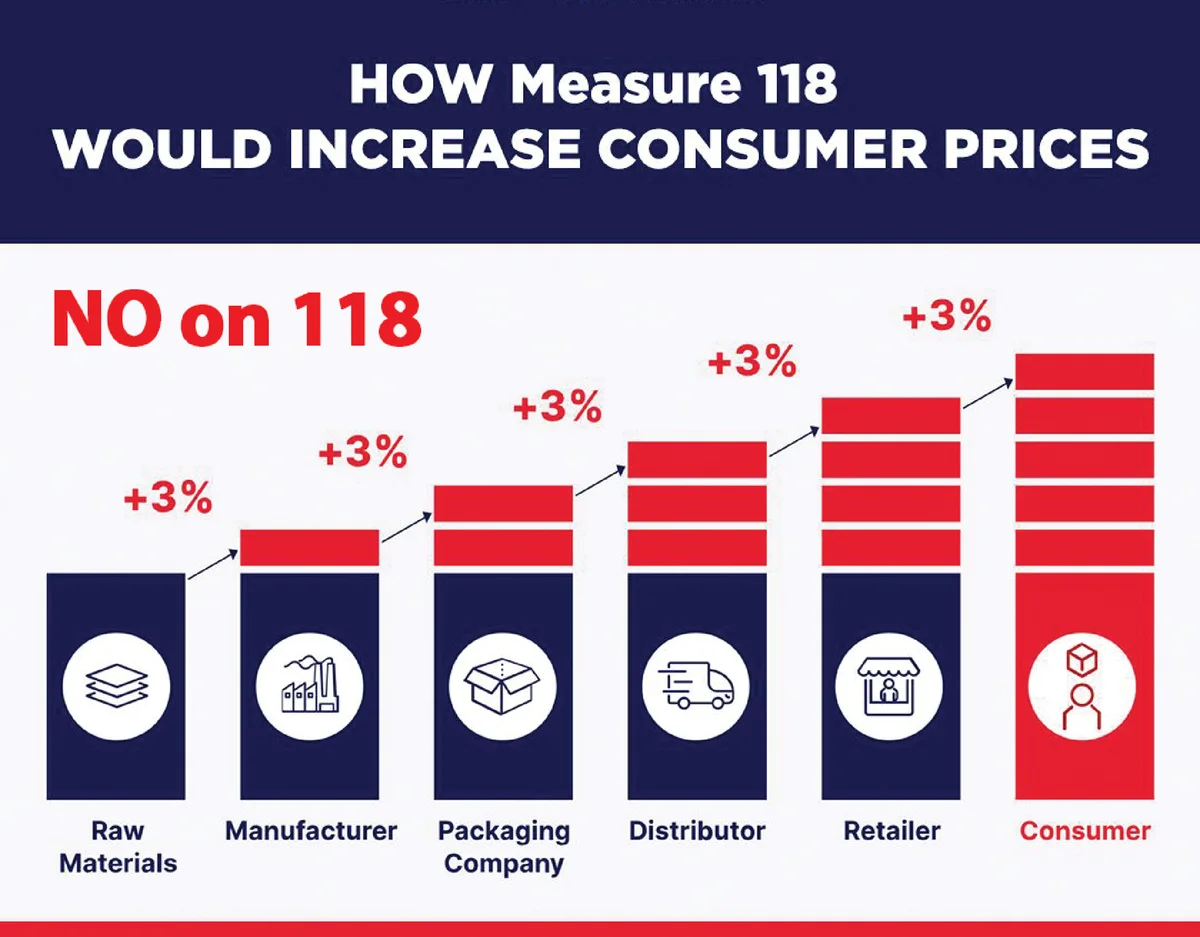

Measure 118 would create a $6.8 billion annual tax on sales without any exceptions or exclusions. The largest tax increase in Oregon’s history, this tax on sales would be paid directly by businesses with more than $25 million in annual Oregon sales, regardless of whether the company made a large or small profit, or even lost money. And, as is always the case with taxes on sales, the tax would be passed along to those companies’ customers, which include both individuals and other businesses. As a result, costs would rise for nearly everything bought in sold in the state, including food and medicine.

How would Measure 118 hurt families and companies?

It would hurt families directly by raising the cost of everything they need to live in Oregon, including food, clothing, drugs, housing, fuel, you name it. Oregon is an expensive state in which to live, and Measure 118 would make it even more expensive. Think about the fact that this taxes the sale of medicine or medical services – people get sick and Measure 118 would punish them more with a sales tax? The cost of goods and services used by companies would go up as well, even if they were too small to pay the tax directly. Take a neighborhood restaurant, for example. That restaurant buys food, beverages, cleaning supplies, food service equipment, furnishings, cable TV, rent, insurance, advertising, and lots of energy for cooking and heating. The cost of all of those things likely would rise under Measure 118’s record tax increase, forcing that restaurant to raise prices, cut jobs or maybe even close. Also consider a family farm. Costs for seeds, fertilizer, fuel, equipment, insurance, packaging and other things would rise. Because many farmers sell to markets outside the state and compete against farmers in lower-cost states, they can’t always pass along increased costs. Measure 118 would make farming in Oregon far more difficult.

How was the ballot initiative process and the Yes on Measure 118 campaign funded?

The signature-gathering process was funded largely by wealthy people living outside of Oregon who do not have to pay the tax or pay the higher prices it will cause. Since signature gathering, the single largest contribution to the campaign is from a candidate for San Francisco mayor, according to Willamette Week.

Why are so many Oregon businesses, organizations and elected officials opposing this ballot measure?

Measure 118, which was written by a group of people in a Eugene coffee shop, is seriously flawed, and there are a lot of things to not like about it. In fact, Tax Fairness Oregon called it a “hot mess” in a post. The simplest reason is that it enacts a sales tax that would result in higher prices at the worst possible time. It’s also worse that a traditional sales tax because it could apply at every step of the supply chain, creating a tax on a tax on a tax. This makes Oregon products and Oregon companies less competitive and makes operating in Oregon much more difficult.

It’s worth noting that opposition to Measure 118 comes from many places on the political spectrum, which illustrates how flawed it is. Democrats and Republicans, business and labor, left-leaning and right-leaning groups, nonprofits and businesses of all sizes – different organizations and individuals probably have different reasons for opposing it, but they are in fact united in opposition to a measure that will make life more expensive for everyone.

How would Measure 118 damage Oregon’s business reputation and hurt Oregonians long-term?

Enacting a costly tax on sales that is magnitudes larger than any tax of its kind in the nation would damage Oregon’s business reputation further. The $6.8 billion annual tax would provide a powerful incentive for Oregon businesses to invest and grow in other states and for businesses operating elsewhere not to invest in Oregon at all. Because businesses provide jobs and opportunities for Oregonians, people would have fewer of both as businesses invested elsewhere. And that’s in addition to the higher costs the measure would create. The nonpartisan Legislative Revenue Office reports that Measure 118 would create even more inflation while also dampening growth in wages, income, jobs and population.

What else should voters know about Measure 118?

Voters know this, but it’s worth repeating: There is no such thing as free money. Someone always pays, and that “someone” here would be Oregonians – individuals, families, small businesses, etc. We encourage everyone to visit NOonMeasure118.com to get the facts, learn more and join our growing coalition.

Please describe OBI and how it helps Oregon businesses.

OBI’s mission is to strengthen Oregon’s economy in order to achieve a healthy, prosperous and competitive Oregon for the benefit of future generations. That mission recognizes the fact that Oregon needs a healthy private sector where businesses can create jobs, provide incomes and generate the economic activity necessary for the state to thrive. It’s that activity that supports individual prosperity, philanthropy of all types and tax revenue for critical services like public education and public safety. OBI helps advance policy that can create the conditions businesses need to innovate and to thrive in Oregon. Most of that work involves research, advocacy and education. We have about 1,600 members from across the state and in a wide variety of industries. OBI’s members, more than 80% of which are small businesses, collectively employ more than 250,000 Oregonians. People can learn more at www.OregonBusinessIndustry.com.

Tell us about yourself.

I’m a native Oregonian, born in Klamath Falls and raised in Beaverton. I grew up in a house where public service and civic engagement were fostered and encouraged. I’ve worked in or around Oregon politics and government for more than 20 years – sometimes as a staffer (former U.S. Rep. Greg Walden, former Oregon House Co-Speaker Bruce Hanna), as a university employee, as an attorney and now as head of a statewide membership association advocating for a healthy economy. In all of these roles, I’ve sought to keep Oregon a state in which all people can live and thrive. It’s an honor to chair the coalition – Defeat the Costly Tax on Sales – united in opposition to Measure 118.

Richard Emmons is the Publisher and Editor of the Oregon Eagle.